Historical Cost Concept Definition and Examples

Список индикаторов технического анализа для торговли на Форекс

July 17, 2024Immediate Gambling Establishment Play: A Convenient Way to Take Pleasure In Online Betting1

February 22, 2025

These adjustments give investors and analysts a more accurate and relevant picture of a company’s financial position, which can help them make more informed investment decisions. Per US GAAP, the PPE is recorded at the historical cost and required to change the value in the financial statements even if the market value of https://www.bookstime.com/articles/how-to-calculate-overtime-pay assets increases or decreases. The Historical cost accounting principles are used mainly to record and measure the value of items in the balance sheet rather than items in the Income statements.

Exceptions to the historical cost basis of accounting

It declares that all assets, liabilities, and expenses should be documented at their acquired cost. The two most common methods of historical cost are First In, First Out (FIFO) and Last In, Last Out (LIFO). Fixed assets exist for an extended period, so they often depreciate or increase in value. Thus, it is crucial to record the original cost of each asset so that you can make adjustments later on.

Impaired Intangible Assets

When companies acquire new assets, the cost principle provides a clear and objective method for recording these transactions, ensuring that the initial investment is accurately reflected in the financial statements. This initial valuation serves as a baseline for future financial analysis, helping companies track the performance and utilization of their assets over time. Lack of Reflection of Current Market ValueHistorical cost accounting does not always reflect the current market value of an asset. In cases where markets fluctuate frequently, and the value of assets changes drastically, historical cost may not provide a clear picture of a company’s financial position. When it comes to financial reporting, the choice between MTM and historical cost accounting depends on factors like regulatory requirements, nature of assets, and industry-specific standards.

Price/Earnings-to-Growth (PEG) Ratio: What It Is and the Formula

Therefore, historical cost is an essential tool for decision-making in companies. Tax laws often require that certain expenses be capitalized and amortized over some time. For example, costs incurred to develop a new product may need to be capitalized and amortized over the product’s estimated life. Adjustments may need to be made to the financial statements to reflect the correct amount of expenses capitalized for tax purposes. The Historical Cost Principle affects the calculation of taxable income because it determines the value of assets and liabilities used to calculate the tax base. Using the Historical Cost Principle, the tax base often equals the book value of assets and liabilities reported on the financial statements.

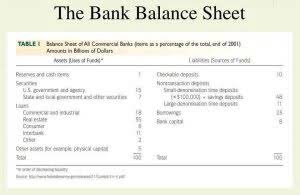

For fixed and long-term assets, a depreciation expense is used to reduce the value of the assets over their useful life. In the case where the value of an asset has been impaired, such as when a piece of machinery becomes obsolete, an impairment charge MUST be taken to bring the recorded value of the asset to its net realizable value. Assets recorded at historical cost must be updated to reflect usage-related wear and tear in compliance with the conservative accounting principle. Depreciation expenses are used to decrease the value of fixed and long-term assets over the course of their useful lives. When an asset’s value has been diminished, as a piece of equipment unearned revenue becomes outdated, an impairment charge MUST be applied to restore the asset’s recorded value to its net realizable value. One of the key financial statements is the balance sheet, which shows the assets, liabilities, and equity at the end of the most recent reporting period.

The historical cost principle offers a reliable and objective basis for valuing assets and liabilities in a company’s financial statements. This helps to reduce subjectivity in accounting and makes the financial statements more reliable. The historical cost principle provides an objective and reliable basis for valuing assets and liabilities in a company’s financial statements.

In conclusion, the historical cost is used to measure the cost principle asset’s value for financial purposes, but not all assets can be measured by their historical costs. Impaired assets, intangible assets, and marketable securities are recorded at their current market prices on the balance sheet. The concept of historical cost is used to prevent overstating an asset’s value when the appreciation of that asset was the result of market volatility. The historical cost principle is the basic accounting principle widely used in the U.S. under GAAP. Most assets are listed on the balance sheet at their historical cost, even if their value has heavily increased over time.

- This can result in understated expenses and overstated profits, potentially misleading stakeholders about the company’s true financial performance.

- One of the key financial statements is the balance sheet, which shows the assets, liabilities, and equity at the end of the most recent reporting period.

- Historical cost is the original cost of an asset, as recorded in an entity’s accounting records.

- By not reflecting the current market value of assets, financial statements may not provide an accurate picture of a company’s financial health.

- A business asset will be worth more in good economic conditions and thus would be able to fetch a higher price as compared to selling the asset during a recession.

- Go a level deeper with us and investigate the potential impacts of climate change on investments like your retirement account.

What is Fair Value?

- Historical cost is essential for calculating depreciation – a critical component of accounting for wear and tear on long-lived assets.

- The write-down of this impairment would result in a reduction in shareholder equity on the balance sheet and an expense on the income statement.

- Fair value accounting would reflect this current market value, providing stakeholders with a more up-to-date picture of the company’s assets.

- The replacement value (i.e. $40,000) and fair value (i.e. $6,000) would not be considered in the valuation.

- The asset’s market value represents the amount of cash flow that could be generated in the future through prospective sales.

Cash flow statements benefit from the historical cost principle by providing clarity on the actual cash outflows related to asset purchases. Since assets are recorded at their purchase price, the cash flow statement accurately reflects the cash spent, aiding in better cash management and forecasting. This transparency is crucial for stakeholders who rely on cash flow information to assess the liquidity and operational efficiency of a company. Assets are listed at their acquisition cost, which can sometimes result in undervaluation, especially in times of inflation or significant market appreciation. For instance, a piece of land purchased decades ago at a nominal price may now be worth substantially more, yet it remains recorded at its original cost. This can lead to a conservative portrayal of a company’s asset base, potentially affecting the perceived financial strength of the organization.